FP&A

Choosing the scale for a graph

The scale for a graph axis can have significant impact on how an audience interprets a message and is an important part of optimising data visualization.

The scale selected for a graph axis has a significant impact on how the audience interprets the message and is an important part of optimising data visualisation. Here we cover the common issues financial planning & analysis professionals face when selecting chart axes and outline best practice guidelines.

Common constraints faced when choosing graph scales

- The range of the tick marks on each scale to include the range of all the data to be plotted

- The desire for the scales to be the same on all graphs within a composite panel for ease of audience interpretation The need for a particular value (such as zero) to be included in a scale

- The need for the chart to appropriately show the key trends in the data (often skewed by anomalies)

- The desire for data points not to appear on the axes

Best practice visualization concept 1 – consider how the graph encodes the data

Different chart types encode data in different ways, understanding how your graph encodes the data is key to selecting the appropriate axis scale. Line graphs and dot charts emphasize the differences between values. However, in bar charts it is the length of the bar representing the absolute value of the data point that is the primary visual display and therefore of most importance. Different graph types subsequently have different principles for selecting scales.For more on selecting the right graph type see Chart Chooser for trends

Abhishek Singh

Global Client Delivery Director

Abhi joined us in 2011 and heads up our Client Delivery Team from our US office. A devoted fan of the Indian cricket team and, when not watching cricket, plays cricket at a high level himself.

FOLLOW US

Best practice visualization concept 2 – always include zero if possible

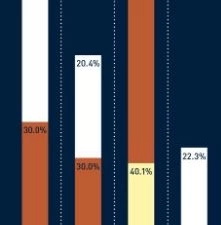

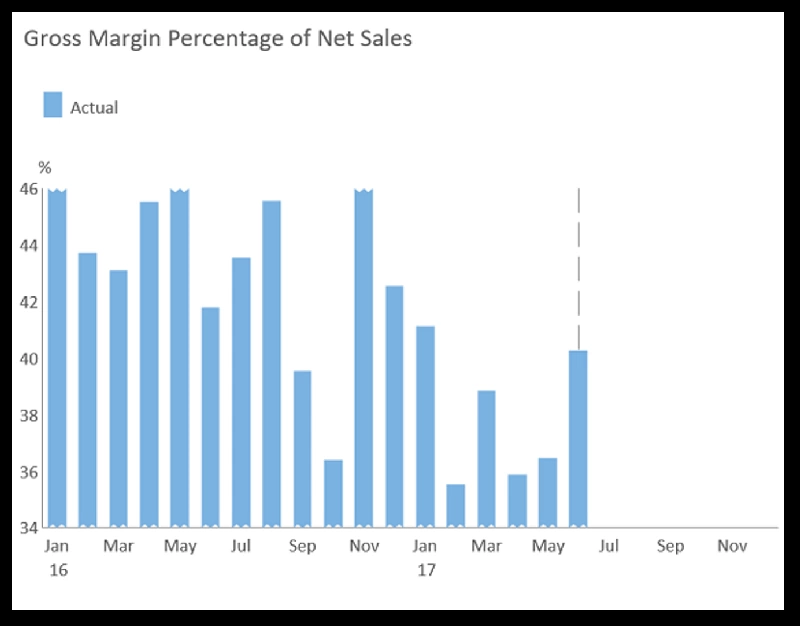

For bar charts, the axis should always start at zero since it is the length of the bar that is being used to encode the data.In Figure 1.0 the zigzags at the base of the bars are intended to warn the reader that the scale does not include zero. However, the bar lengths are meaningless in this rendition of the graph since they encode the data minus the arbitrary value 34.

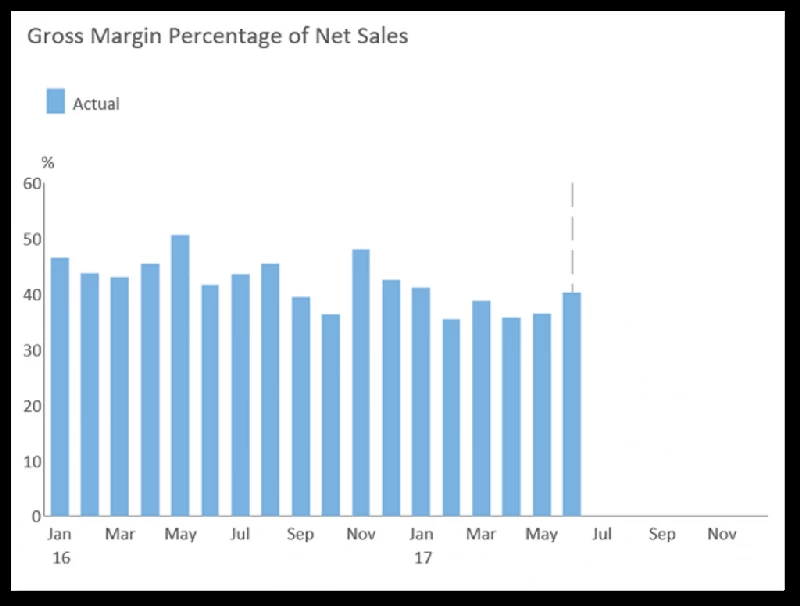

Figure 1.0 – scale does not start at zero[/caption]If a bar chart is preferred, it should always include zero as Figure 2.0 shows:

Figure 2.0 – bar graph scale should always start at zero[/caption]For line and dot charts, where appropriate, zero should also be included on the scale. This is to provide consistency with any other graph types featured on the same panel. It also ensures that trends in the data are not exacerbated misleadingly due to magnified scales. However, please see best practice concept 3 for important exceptions.

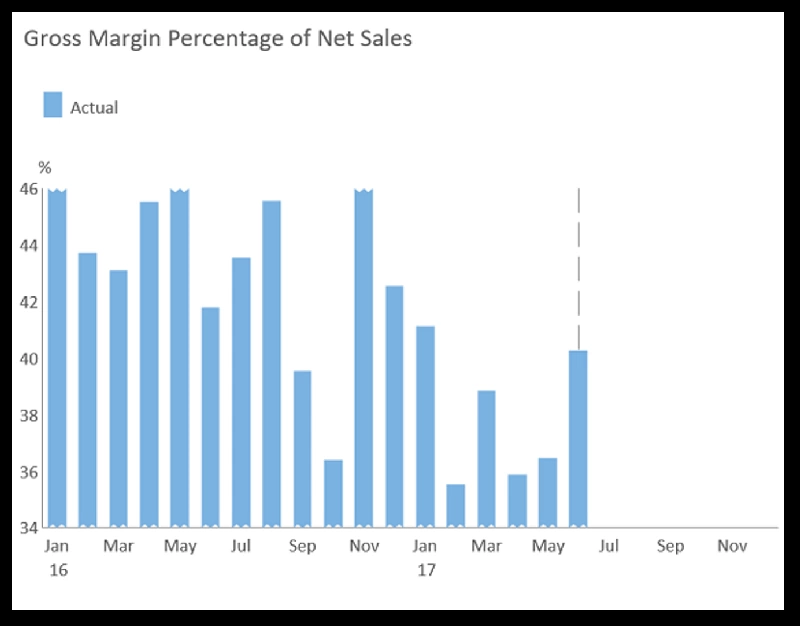

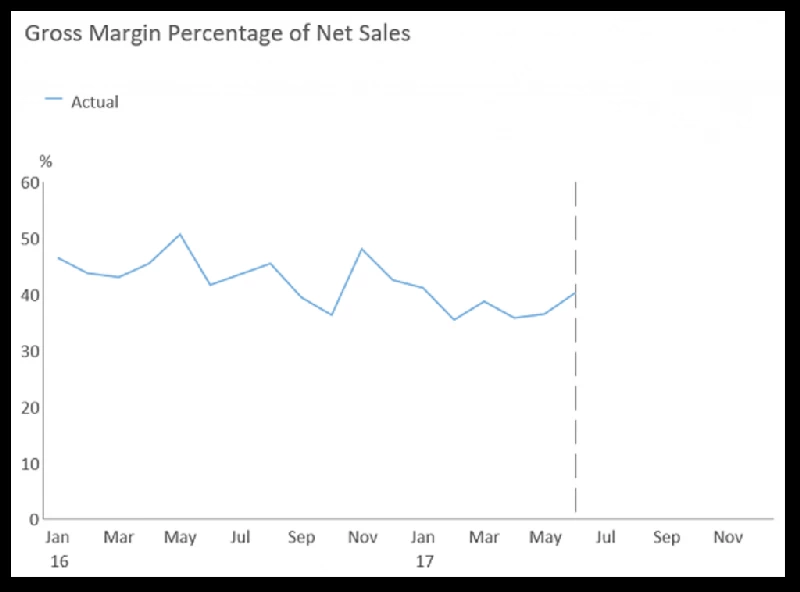

Best practice visualization concept 3 – use as much of the data region as possibleFor line charts, within the constraints above, aim to “use as much of the data region as possible*”. What does this mean? In Figure 3.0 below the space from 0-30% is not utilized, only 15% of the vertical scale is taken up by the data. This wastes space and compromises resolution.

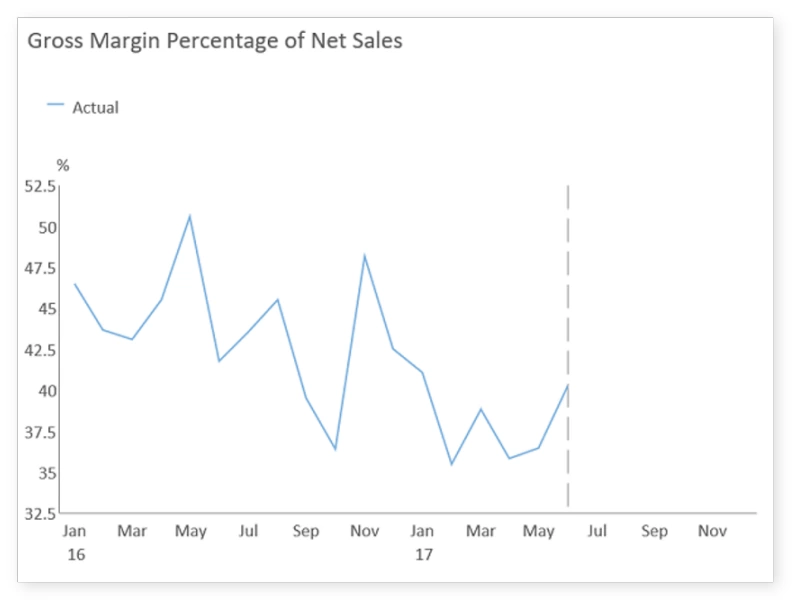

Figure 3.0 – graph does not maximize data region[/caption]In Figure 4.0 the scale has been adjusted to use more of the vertical space, whilst ensuring that the range of tick marks on the vertical scale includes all of the data that has been plotted. This also brings out the trend better, the fluctuation and decline in the metric is easier to interpret than in Figure 3.0.

Figure 4.0 – scale adjusted to use more of the vertical space[/caption]*William S Cleveland, The Elements of Graphich Data, 1985Metapraxis has been at the forefront of data visualization for over 30 years and our research and best practice are integrated into our leading financial analytics platform, Metapraxis Empower.

Latest Posts

FP&A Best Practices

EBOOKS FP&A Best Practices Unlock the potential of your FP&A team with these actionable strategies to elevate performance, leverage meaningful data, align with strategy, and drive success in today's dynamic business landscapeREAD THE FREE EBOOK HERE eBook: 18...

A checklist for an effective dashboard

FP&A A checklist for an effective dashboard A simple 10 point checklist that we give Metapraxis analysts to use when they create an executive dashboard. Does the design and layout of the dashboard conform to current best practice and quality standards? Is there an...

Today’s misleading infographic

FP&A Today's misleading infographic The Raconteur supplement in the Times contains a large centre spread infographic entitled “How UK compares to European rivals”.The supplement in today’s Times newspaper published by Raconteur contains a large centre spread...