FP&A

Fresh foods sector: understanding profitability

We look at recent data from the UK retail industry, and at how profitability analysis can help make the most of seasonal variations in demand.

Received wisdom may dictate that January is a lean month for food retailers. But health-conscious behaviour means that groceries is one part of the sector where that tradition may be ending. Research released this week showed that sales of fresh fruit and vegetables, nuts, poultry and fish all rose strongly in January, resulting in an appreciable boost to the sector overall. Increased awareness of healthy lifestyle choices has clearly had an impact on consumers’ post-Christmas behaviour, if not so much on the festive binge itself.

Of course, this isn’t a completely unpredictable phenomenon, but making the most of this and other seasonal variations in the year is a challenge throughout the industry. This is particularly true where fresh prepared foods are concerned, as raw materials are perishable and the true costs of manufacturing are not always clear.

However, that complexity represents an opportunity for businesses with a good understanding (and, therefore, good control) of costs and profit at the SKU level. In the case of fresh prepared foods companies, being able to analyse the true costs involved in manufacturing a particular product (as opposed to the standard costs) makes it possible to identify potential for process improvement leading to well targeted cost reduction. It also enables those companies to work with retailers on specific promotions that will return positive profit margins.

Most organisations capture the information needed to make decisions such as this, but most do so in separate siloed systems. A system of data integration of that avoids the need for a costly data warehouse project is one part of the solution. But truly reliable figures can only really be achieved by basing calculations on an accurate mathematical model of the business.

An analytics tool like this, focused on the optimisation of margin, can be retrospectively tested against actual results, and refined as part of an iterative process. Such technology can inform both day-to-day operations and long-term strategy, and means that retail suppliers are better-placed to negotiate pricing and supplier deals.

FOLLOW US

Latest Posts

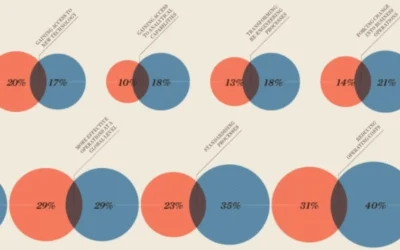

Why bars are better than bubbles

FP&A Why bars are better than bubbles The infographic in Raconteur includes a chart that aims to make quantitative comparisons through the use of circles of different areas.The infographic in the Raconteur supplement distributed with today’s Times includes a chart...

Excel vs. FP&A Platforms: Choosing the Right Vehicle for Your Financial Journey

FP&A Excel vs. FP&A Platforms: Choosing the Right Vehicle for Your Financial Journey Discover why FP&A platforms are like modern off-road vehicles, purpose-built for your data-driven financial expedition.Imagine you're embarking on a cross-country road...

Revolutionising FP&A with the Intelligence Processing System (IPS)

FP&A Revolutionising FP&A with the Intelligence Processing System (IPS) Experience the future of FP&A with the Intelligence Processing System (IPS). Revolutionize your FP&A, leaving behind Excel's limitations. Welcome an era of data-driven...