FP&A

Maximizing Private Equity Value Creation through Data and Analytics

Uncover the evolving landscape of private equity value creation, where data analytics and ESG integration play pivotal roles. Harness transformative, data-driven strategies for that crucial competitive edge!

The landscape of private equity is undergoing a rapid transformation, highlighting the profound significance of data and analytics as catalysts for unlocking untapped value within portfolio companies. Traditional private equity methodologies, once reliant on historical data and conventional strategies, are now facing a profound re-evaluation in the face of a swiftly evolving environment.

In recent studies, including PwC’s analysis of the PE industry’s evolution over the past decade, underscore a significant shift in value creation strategies. While historical approaches remain foundational, 40% of surveyed portfolio company respondents are prioritizing digitization and automation, recognizing the transformative potential of data and technology in bolstering portfolio performance.

Furthermore, the integration of Environmental, Social, and Governance (ESG) factors has emerged as a pivotal dimension in private equity. According to PwC’s Private Equity Trends report, the emphasis on ESG considerations has become more prevalent within the industry. Nearly 80% of limited partners (LPs) now expect PE firms to assess and report on ESG metrics regularly. This shift indicates a growing realization of the inherent value that responsible and sustainable practices bring not just to portfolio companies but to the overall investment landscape.

However, this transformation is not without challenges. The increasing talent demand within private equity firms is outstripping the availability of qualified personnel, hindering effective business operations. Private Equity International, 2023’s analysis highlights the scarcity of individuals equipped to navigate companies through the intricacies of deal cycles. This scarcity emphasizes the urgency for private equity firms to harness data and invest in talent with the necessary skill set to drive value creation through data-driven strategies.

Mick Heywood

Head of Client Partnerships

I’ve had the privilege of working with clients across Europe, the USA, and Asia, achieving remarkable success in a short time. Many individuals I’ve collaborated with are now close friends.

Outside the office, you can find me tinkering with my old car in the garage or walking with my chocolate Lab, Zepp.

FOLLOW US

Additionally, Forbes highlights an alarming aspect within the industry. PwC’s 2022 Next in Private Equity Survey indicated that 54% of PEs use email attachments to collect data from portfolio companies, while 36% write responses within the email body. This reliance on an antiquated method in a sophisticated data-driven industry underlines the need for urgent improvement and modernization in data collection strategies.

The urgency for a data-centric approach is underscored by statistics revealing PE firms’ reliance on error-prone data collection methods, emphasizing the need for modernization in data collection strategies.

The urgency surrounding data lies in its ability to drive speed, precision, and informed decision-making. Timely access to pertinent data empowers firms to adapt swiftly to strategic shifts and identify new opportunities for value creation. However, despite this, private equity firms often grapple with scattered data or a lack of talent and digital expertise to effectively harness and integrate information.

This shift in approach involves exploring advanced analytics, artificial intelligence, and machine learning capabilities to extract deeper insights from available data sets. It’s crucial to foster a culture that values data interpretation skills and upskill talent to leverage data effectively.

Initiating a data transformation strategy within portfolio companies necessitates a holistic assessment of existing capabilities and subsequent enhancements. Revamping data collection methods, refining data analysis processes, and empowering the workforce in effective data utilization are crucial steps. This transformation encompasses technological upgrades, cultural shifts, and strategic planning, aiming to establish unified data repositories shared by all stakeholders to ensure consistency and facilitate seamless interactions.

Thriving in this landscape demands embracing a data-centric future, rethinking strategies, and transforming approaches to data and analytics. Forward-thinking private equity firms are embedding data-driven decision-making processes into their DNA, utilizing data not only to drive value creation but also to adapt swiftly to changing market conditions and foster a competitive edge in the industry.

Latest Posts

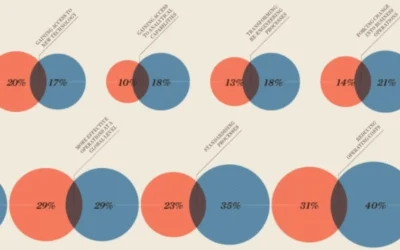

Why bars are better than bubbles

FP&A Why bars are better than bubbles The infographic in Raconteur includes a chart that aims to make quantitative comparisons through the use of circles of different areas.The infographic in the Raconteur supplement distributed with today’s Times includes a chart...

Excel vs. FP&A Platforms: Choosing the Right Vehicle for Your Financial Journey

FP&A Excel vs. FP&A Platforms: Choosing the Right Vehicle for Your Financial Journey Discover why FP&A platforms are like modern off-road vehicles, purpose-built for your data-driven financial expedition.Imagine you're embarking on a cross-country road...

Revolutionising FP&A with the Intelligence Processing System (IPS)

FP&A Revolutionising FP&A with the Intelligence Processing System (IPS) Experience the future of FP&A with the Intelligence Processing System (IPS). Revolutionize your FP&A, leaving behind Excel's limitations. Welcome an era of data-driven...