FP&A

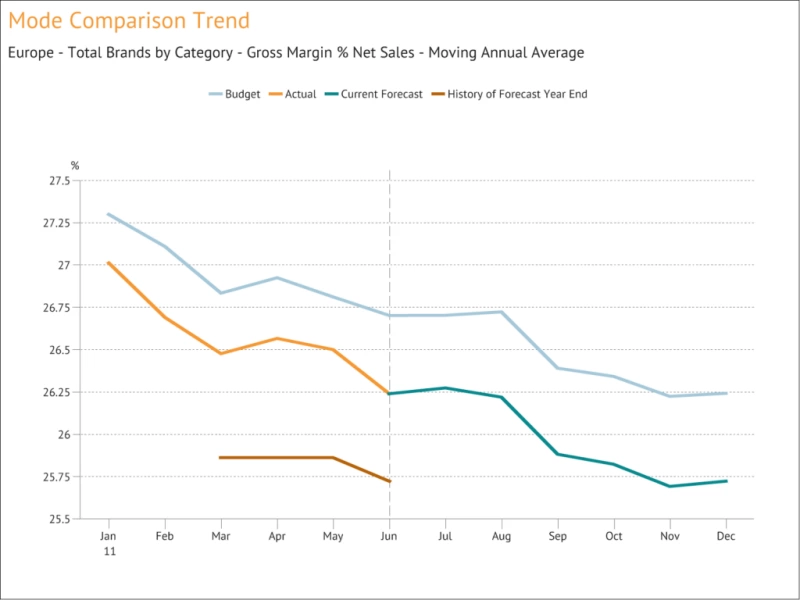

Moving Annual Average – a powerful data transformation

Learn how to use a process to calculating an MAT

We can’t use an MAT for a stock type item (like Accounts Receivable or Headcount) or a statistic (such as gross margin % or the £/$ Exchange Rate) because totalling these items overtime periods doesn’t make any sense.

In a previous post, we looked at the Moving Annual Total (MAT) as a simple, powerful way of eliminating seasonality within a 12 month period to enable the underlying trend of a data series to be discovered.

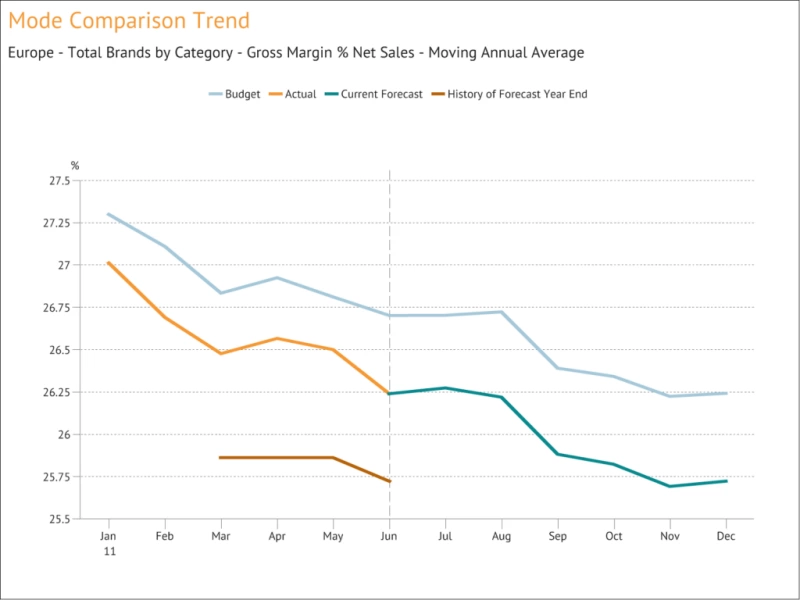

The MAT works fine for items that flow, like Sales, Profit and Shipment Volumes because these can be cumulated over time periods to provide meaningful totals. But we can’t use an MAT for a stock type item (like Accounts Receivable or Headcount) or a statistic (such as Gross Margin % or the £/$ Exchange Rate) because totalling these items over time periods doesn’t make any sense. The solution is to calculate the Moving Annual Average (MAA). The simplest way to calculate this is to use a very similar process to calculating an MAT – the end result is then divided by 12 (or however many periods we have within our year) to provide an average monthly value.

In cases of statistics like Gross Margin % (made from a flow item divided by another flow item), we can construct a more accurate weighted average value for each month by calculating the total of the last 12 months for both the numerator and denominator of the ratio and then dividing one by the other.

Abhishek Singh

Global Client Delivery Director

Abhi joined us in 2011 and heads up our Client Delivery Team from our US office. A devoted fan of the Indian cricket team and, when not watching cricket, plays cricket at a high level himself.

FOLLOW US

A statistic such as Return on Capital Employed % (made from a flow item divided by a stock item) requires a more elaborate calculation, because by convention the value for such a ratio is normally displayed as an annual value. Hence, we need to calculate the total of the last 12 months Profit and divide by the weighted average of Capital Employed over that 12 month period. The MAA transformation of data is very flexible because it can be applied to all types of data items, whether they are flows, stocks or statistics. By comparison, MATs can only be calculated for flow type items so must be used with care.

Latest Posts

FP&A Best Practices

EBOOKS FP&A Best Practices Unlock the potential of your FP&A team with these actionable strategies to elevate performance, leverage meaningful data, align with strategy, and drive success in today's dynamic business landscapeREAD THE FREE EBOOK HERE eBook: 18...

A checklist for an effective dashboard

FP&A A checklist for an effective dashboard A simple 10 point checklist that we give Metapraxis analysts to use when they create an executive dashboard. Does the design and layout of the dashboard conform to current best practice and quality standards? Is there an...

Today’s misleading infographic

FP&A Today's misleading infographic The Raconteur supplement in the Times contains a large centre spread infographic entitled “How UK compares to European rivals”.The supplement in today’s Times newspaper published by Raconteur contains a large centre spread...