FP&A

Navigating the Complexities of Franchise Business Management

Franchise businesses face significant challenges in balancing operational demands with strategic growth, often hindered by inefficient processes and systems that must evolve to drive performance and meet stakeholder expectations.

As franchise business leaders, you’re often tasked with the herculean effort of balancing day-to-day operations with the strategic demands of growth. But behind the scenes, there are persistent challenges that many are all too familiar with—challenges that, if left unchecked, can hinder progress and decision-making.

One of the recurring pain points I’ve observed is the reliance on manual processes to export data from franchisor systems, often ending up in a maze of Excel workbooks. While Excel is a versatile tool, this manual integration is time-consuming and prone to errors. It pulls key players away from strategic work, as they’re buried in data clean-up instead of analysis.

A large issue with driving most reporting through Excel is integrating high-quality reporting with the workflow for operators. Franchise operators are highly knowledgeable and skilled at running their locations, but are often not finance native and may struggle with utilizing the same tools finance use. Dedicated reporting tools, that can consolidate and present the right information to educate and explain financial performance to operators, can drive accountability throughout the business.

Even more challenging is the difficulty in presenting the outputs of these plans to Private Equity (PE) owners or boards. The expectations from these stakeholders are high—they demand clarity, precision, and actionable insights. However, many of the systems in place aren’t designed to cater to the unique demands of PE-backed franchises. Instead, franchise leaders often find themselves contorting data and reports into formats that don’t quite fit, leading to misalignment and frustration on all sides.

These issues aren’t just about inefficiency—they’re about the friction that prevents franchise businesses from effectively driving performance. When your processes and systems aren’t designed to meet the specific needs of your business model, it creates a disconnect between operational data and strategic decision-making, which can be challenging with often highly distributed operating teams and limited central finance resources.

Addressing these challenges requires more than just patchwork solutions. It’s about recognizing that the tools and systems you rely on must evolve in tandem with your business. By investing in platforms and processes that are tailored to the franchise model, leaders can shift their focus from administrative hurdles to driving the business forward.

What are the challenges you’re seeing in your franchise operations? Let’s discuss how we can turn these obstacles into opportunities.

Abhishek Singh

COO

Abhi joined Metapraxis in 2011 and now leads Operations from our US office. A passionate fan of the Indian cricket team, he also plays cricket at a high level when not watching the game.

FOLLOW US

Latest Posts

A checklist for an effective dashboard

FP&A A checklist for an effective dashboard A simple 10 point checklist that we give Metapraxis analysts to use when they create an executive dashboard. Does the design and layout of the dashboard conform to current best practice and quality standards? Is there an...

Today’s misleading infographic

FP&A Today's misleading infographic The Raconteur supplement in the Times contains a large centre spread infographic entitled “How UK compares to European rivals”.The supplement in today’s Times newspaper published by Raconteur contains a large centre spread...

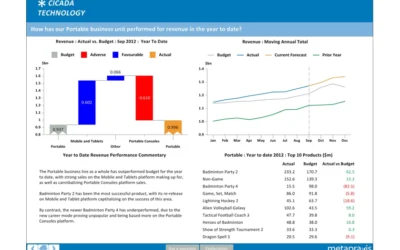

What makes a good Board Report?

FP&A What makes a good Board Report? We have created a set of key principles for companies looking to improve the relevance and usefulness of their Board ReportA company’s board of directors is collectively responsible for leading and directing its affairs in...