FP&A

The Excel Dilemma: Recognising its Limits in Finance and the Need to Evolve

Discover the limitations of Excel in modern finance and why specialized FP&A platforms are the key to unlocking a more efficient and data-driven future.

Introduction

Microsoft Excel, with its humble origins in the early 1980s, has long been the workhorse of finance departments worldwide. It has played a pivotal role in streamlining financial processes, data analysis, and reporting for decades. Yet, as we sail further into the digital age, it’s crucial to acknowledge that while Excel remains a fundamental tool, it might no longer be the ideal solution for modern finance and Financial Planning & Analysis (FP&A) teams.

The Rise of Excel

Excel’s journey from a basic spreadsheet program to a multifaceted tool for financial professionals has been nothing short of remarkable. It has empowered finance departments to efficiently handle complex calculations, data modelling, and reporting. Its user-friendly interface and formulaic capabilities have made it indispensable in financial forecasting, budgeting, and scenario planning. Most recently the addition of Python capabilities have brought Excel up to date with other CPM platforms.

Abhishek Singh

COO

Abhi joined us in 2011 and heads up Operations from our US office. A devoted fan of the Indian cricket team and, when not watching cricket, plays cricket at a high level himself.

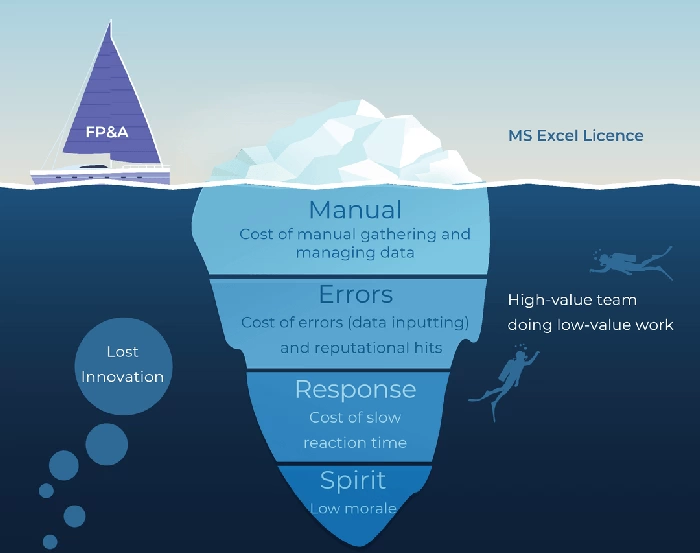

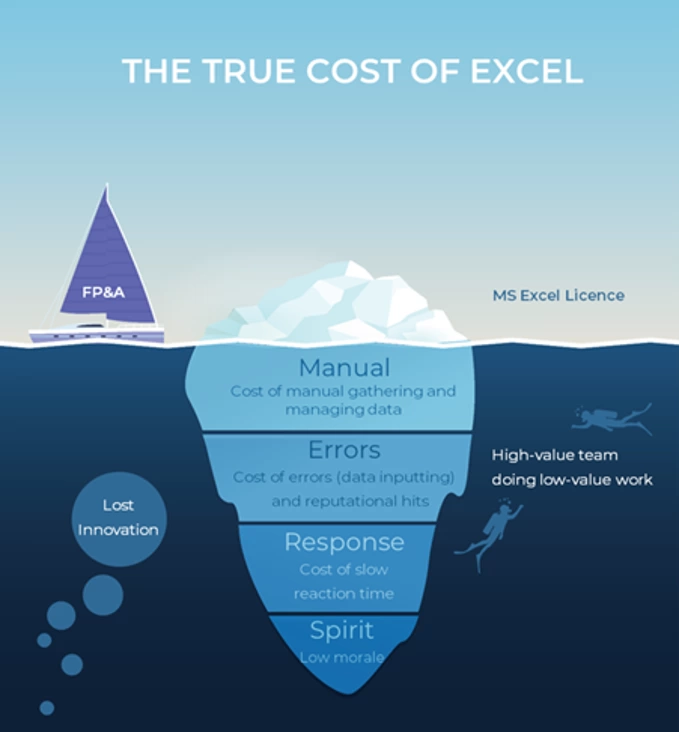

The Hidden Iceberg

However, much like an iceberg with a hidden underside, Excel’s limitations can sometimes be obscured by its apparent versatility. Finance professionals often find themselves grappling with several issues related to data integrity, version control, collaboration, and the inherent risk of human error in large, intricate spreadsheets.

As finance grows increasingly data-driven, and demands more sophisticated analysis and reporting, Excel’s inadequacies are becoming more evident. Here are some of the key reasons why Excel might not be the ideal long-term solution for FP&A teams:

- Data Scalability: Excel struggles to handle large datasets efficiently, causing slow performance and increasing the risk of errors. As businesses generate ever-increasing volumes of data, this limitation becomes more pronounced.

- Version Control: Collaborative work on Excel files can be challenging, leading to version control issues. When multiple team members are working on the same spreadsheet, maintaining data integrity can be a daunting task. Whilst use of SharePoint, OneDrive and web-browser based versions of Excel can mitigate this, the inherent risk is that versions can live outside of the formal channels of control.

- Limited Automation: While Excel allows for some automation through macros, it falls short in providing the level of automation that modern FP&A processes require. The new integration with Python does

- Lack of Integration: Integrating Excel with other software or data sources can be cumbersome, limiting the ability to access real-time data and create holistic financial models.

- Inadequate Audit Trail: Maintaining an audit trail in Excel can be burdensome and prone to errors, potentially causing compliance and reporting issues.

The Need for Evolution:

To meet the evolving demands of finance and FP&A, it’s time to consider specific FP&A platforms and solutions. These platforms are designed to address the shortcomings of Excel while enhancing financial planning, analysis, and reporting processes.

- Advanced Data Analytics: FP&A platforms offer robust data analytics capabilities, allowing for real-time analysis and scenario modelling.

Streamlined Collaboration: These platforms provide centralised, cloud-based solutions that enable seamless collaboration among team members, eliminating version control issues. - Automation and Integration: FP&A solutions come equipped with automation features that simplify repetitive tasks and seamless integration with other software and data sources.

- Enhanced Audit Trail: Maintaining an accurate and reliable audit trail is more straightforward with specialized FP&A tools, ensuring compliance and regulatory adherence.

- Scalability: Modern FP&A platforms are designed to handle large datasets efficiently, making them suitable for businesses of all sizes.

Conclusion:

While Excel has served as a reliable companion to finance and FP&A professionals for decades, it’s essential to recognize its limitations in the face of evolving demands. Embracing specialized FP&A platforms and solutions can not only mitigate the risks associated with Excel but also unlock new possibilities for FP&A.

Excel may always have a place in our financial toolkit, but the iceberg has been spotted, and it’s time to set sail toward a more efficient and data-driven future with dedicated FP&A platforms at the helm.

Latest Posts

What makes a good Board Report?

FP&A What makes a good Board Report? We have created a set of key principles for companies looking to improve the relevance and usefulness of their Board ReportA company’s board of directors is collectively responsible for leading and directing its affairs in...

Fresh foods sector: understanding profitability

FP&A Fresh foods sector: understanding profitability We look at recent data from the UK retail industry, and at how profitability analysis can help make the most of seasonal variations in demand.Received wisdom may dictate that January is a lean month for food...

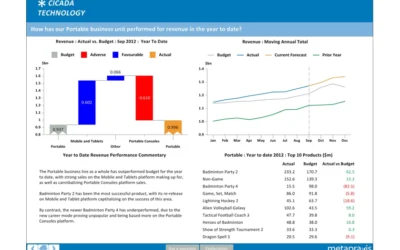

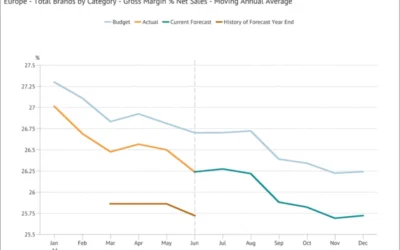

Moving Annual Average – a powerful data transformation

FP&A Moving Annual Average - a powerful data transformation Learn how to use a process to calculating an MATWe can’t use an MAT for a stock type item (like Accounts Receivable or Headcount) or a statistic (such as gross margin % or the £/$ Exchange Rate) because...