FP&A

What does 2024 look like for FP&A teams?

2024 poses unique challenges for FP&A teams amidst a shifting financial landscape. Here we delve into the anticipated obstacles, developmental prospects, and socio-economic trends that will shape the course of businesses in the upcoming year.

Challenges Ahead

1.Ongoing Market Uncertainty

The persisting conflict in Ukraine continues to cast shadows over markets, driving fluctuations in energy and food prices. Additionally, the looming destabilization across the Middle East poses potential risks that could reverberate throughout the region, contributing to market volatility.

2. Inflationary Pressures

Inflation remains a persistent challenge for both businesses and individual consumers. The repercussions of inflation on operational costs, borrowing plans, and staff salaries continue to weigh heavily on financial planning.

Anouska Backshall

Head of Customer Insights

Joined the team in 2011 and is responsible for delivering the internal and external communications agenda, as well as providing design and composition of branded content across social media and the company’s digital presence.

3. Misalignment of Expectations

Business strategies often clash with shareholder and market expectations, leading to challenges in preserving margins while facing rising costs of goods sold (COGS). Striking a balance between maintaining margins and expanding market share becomes a delicate act.

4. Legacy Technology and Slow Adoption

The reliance on outdated technologies impedes the agility needed to navigate today’s complex financial landscape. Slow integration of new technologies hinders effective decision-making and adaptation to changing circumstances.

5. Oscillation in ESG Integration

The fluctuating approach towards Environmental, Social, and Governance (ESG) principles poses challenges—whether ESG remains core to business strategies or is merely given lip service during favourable times.

Focus Areas for 2024

Profitability

2024 budgets have now been completed (or will be shortly). For many, this exercise seems somewhat futile. Excel and Google Sheets documents created from August onwards are already outdated, riddled with errors, and layered with the misconceptions and predictions of individuals within a business lacking the rare ability to accurately predict the future. It is fair to say that if someone could correctly predict the central bank’s reaction to events in Q3 2024, they would be unlikely to be responsible for creating a business unit’s annual budgets. They would instead be correctly predicting lottery results, the Grand National, and picking the winner of the Premier League.

However futile, creating the budget allows a business to plan for performance. Ultimately, success for many businesses in the current conditions will be deemed if margins are maintained. This is objectively positive and shows strong stewardship of a business. But what value does planning a margin for a product, business unit, or overall business hold if so much remains in flux and unknowable?

Instead, shouldn’t businesses plan for revenue and accept a fluctuating margin as a cost of doing business in such an era, knowing that improving future conditions will allow for margin improvements? Growth can be reflected in market share or expansion into new areas. While this approach requires caution – cash flow is king – for businesses with a long-term view, improving market share should take priority. Thus, less time should be spent preparing budgets and more on understanding the operational drivers of performance and scenarios in which their interactions change. The focus should be on determining in what scenario certain drivers within our business are more critical than others.

Understanding how likely future scenarios could alter your plan is more critical than the plan itself. Your planned profitability becomes useless in the face of uncertain circumstances.

Balance Sheet Improvement

For many, a business’s balance sheet strength is the true measure of its health. While a Profit and Loss statement might be embarrassing, a robust balance sheet ensures resilience for future challenges. However, this duality can sometimes prompt decision-makers to rely on a strong balance sheet rather than swiftly addressing real-world issues.

Consider real estate as a prime example. Often, pundits lament the “new normal” of the hybrid workplace, urging a return to the office to boost productivity. Yet, this narrative merely glosses over the actual drivers—real estate costs. Leaders, seeing vacant expensive city offices, opt for simplistic solutions instead of taking the more challenging path of renegotiating leases or reassessing real estate assets. This often results in memos mandating office returns, reflecting poor decision-making and leadership.

Instead, organizations should challenge themselves to reshape their balance sheets for future success. Shedding the burden of excessive real estate is one aspect, but planning for the generated cash’s utilization to enhance the business’s position is crucial. Crafting scenarios and responsive plans becomes imperative.

Boosting your cash position in the short term isn’t detrimental; however, deploying it at the opportune moment holds significance. Balance sheet strength, by itself, should not be the ultimate goal.

Inflation

Failure to have mitigation plans for inflation in your business spells trouble. Every facet of your business should have strategies to navigate this challenge successfully.

Consider staff salaries as a simple example. Employees often represent the key to enhancing business performance. If you intend to weather the challenges posed by the aforementioned issues, are you, at the very least, offering adequate pay increases aligned with inflation? Or are you inadvertently diminishing their purchasing power by adhering to pre-existing policies that might no longer suit current economic conditions?

Where are you accommodating inflation, and where are you working to mitigate its effects? Are you crafting strategic combinations (as mentioned earlier regarding scenarios and their implications) to address this issue? Are you contemplating price hikes irrespective of the inflationary impact, merely because it seems more straightforward than challenging the business to adapt to the evolving market landscape?

Summary

There’s little novelty in the mentioned challenges. Many of you who have reached this point are likely familiar with these recurring issues. What needs to change now is how you approach preparation. If you find yourself reliant on Excel, Google Sheets, PowerPoint, or Power BI to handle the range of scenarios you’re encountering, you’re inadequately equipped. Your teams, organizations, and outcomes shouldn’t depend on technology that has seen minimal evolution since its inception. Frankly, it’s akin to using an enhanced abacus while your competitors embrace technologies that streamline, simplify, and significantly enhance decision-making capabilities.

These arguments hinge on having a platform capable of running scenarios for various situations, something Excel lacks. Remaining tethered to it necessitates extensive manual work, tolerates substantial errors, and signifies an inability to adapt swiftly to the changing environment.

Instead, a single individual should seamlessly analyze vast business areas quickly. Implementing uniform pay increases in line with inflation across the board should be achievable, with subsequent reviews of its impact on Profit and Loss, balance sheets, and cash flow projections. If you struggle to achieve this promptly, it might be prudent to consider upgrading from traditional tools before contemplating AI integration into your finance team.

Latest Posts

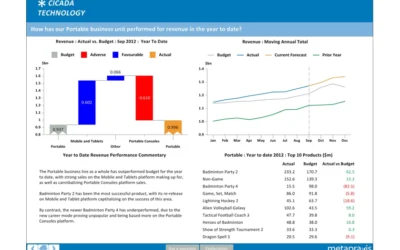

A checklist for an effective dashboard

FP&A A checklist for an effective dashboard A simple 10 point checklist that we give Metapraxis analysts to use when they create an executive dashboard. Does the design and layout of the dashboard conform to current best practice and quality standards? Is there an...

Today’s misleading infographic

FP&A Today's misleading infographic The Raconteur supplement in the Times contains a large centre spread infographic entitled “How UK compares to European rivals”.The supplement in today’s Times newspaper published by Raconteur contains a large centre spread...

What makes a good Board Report?

FP&A What makes a good Board Report? We have created a set of key principles for companies looking to improve the relevance and usefulness of their Board ReportA company’s board of directors is collectively responsible for leading and directing its affairs in...